Venture capital (VC) funding into smart grid technology companies came in at $405 million in 63 deals in 2013, compared to $434 million in 40 deals in 2012. Total corporate funding, including debt and public market financings, came to $579 million in 2013, compared to $506 million in 2012. There were 94 total VC investors in 2013, with 12 active investors participating in multiple deals.

To get a copy of this report, please email us at info@mercomcapital.com.

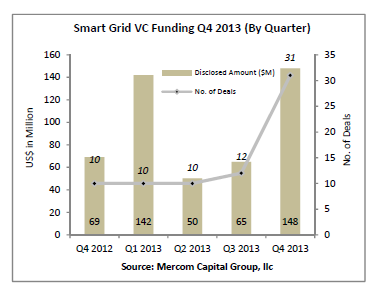

There was a burst of activity in Q4 2013, which netted $148 million in 31 deals. Almost half the deals in 2013 were made in the fourth quarter.

“Deal activity picked up towards the end of the year, and after a long pause, IPOs have made a comeback,” commented Raj Prabhu, CEO and Co-Founder of Mercom Capital Group. “After half a billion dollars of VC investments into home energy companies, the market is finally coalescing around connected home packages as convenience is seen as a better sell with consumers. A single vendor offering a bundle with cable, security, phone and other services and no upfront costs, has removed the barrier for these technologies to find their way into homes.”

There were three IPOs in 2013 (including one in the fourth quarter), raising a combined $162.3 million. Silver Spring Networks, a networking platform and solutions provider for smart energy networks, raised $81 million in its March IPO. Control4, a provider of automation and control solutions for the connected home, raised $64 million through its IPO, and Ideal Power, a developer of a disruptive power converter technology for solar, electric vehicle charging, and commercial grid storage markets, raised $17.3 million in its IPO.

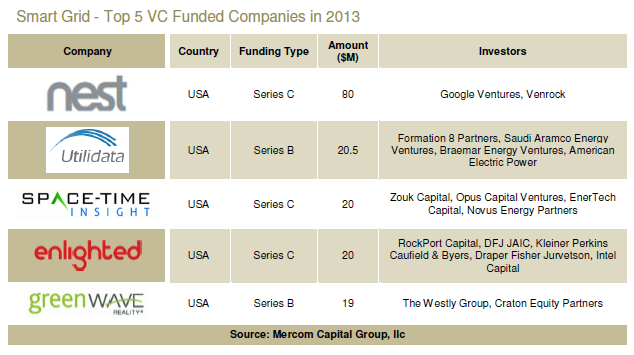

The Top VC funded companies in 2013 were led by Nest Labs, a home energy solution provider and smart thermostat maker, which raised $80 million from Google Ventures and Venrock (Nest was recently acquired by Google for $3.2 billion). Utilidata, a supplier of voltage optimization products for the electric grid, raised $20.5 million from Formation 8 Partners, Saudi Aramco Energy Ventures, Braemar Energy Ventures, and American Electric Power. Space-Time Insight, a provider of geospatial and information visualization software that transforms real-time disparate data into intuitive visual displays that businesses can use to make informed decisions, raised $20 million from Zouk Capital, Opus Capital Ventures, EnerTech Capital, and Novus Energy Partners. Enlighted, a company that uses sensors and analytics to control lighting, temperature and energy consumption in buildings, raised $20 million from RockPort Capital, DFJ JAIC, Kleiner Perkins Caufield & Byers, Draper Fisher Jurvetson, and Intel Capital. GreenWave Reality, a home energy management company, raised $19 million from The Westly Group and Craton Equity Partners.

The top VC investors in 2013 included RockPort Capital Partners with four deals, followed by Khosla Ventures, Kleiner Perkins Caufield & Byers and Navitas Capital with three deals each.

Home/Building Automation & Energy Management companies raised almost half of all VC funding with $190 million in 24 deals. Grid Optimization companies raised $51 million in six deals, Demand Response companies raised $50 million in eight deals, and AMI companies brought in $32 million in eight deals. With about 50 million smart meters installed in the United States, there is a mountain of data for utilities to turn into useful applications, and Mercom saw three Data Analytics companies raising $16 million in this area.

There were 16 M&A transactions that changed hands in 2013 for $5.3 billion. Only five transactions had disclosed dollar amounts. The top disclosed transactions were the $5.2 billion acquisition of Invensys, by Schneider Electric, followed by the $107 million acquisition of JouleX by Cisco, and the $11 million acquisition of Consert by Toshiba.

In terms of consolidation, 18 companies made multiple acquisitions. Since 2010, ABB and Schneider Electric were the most active with six acquisitions each. GE and Siemens made five acquisitions each, followed by EnerNOC with four.

To get a copy of this report, please email us at info@mercomcapital.com.

Smart Grid Companies in Q4 and Annual 2013: ABB, Akuacom, Alstom, Amber Kinetics, Ameresco, AMiHo, Applied Energy Group, Arch Rock Corporation, Asais, ASAT Solutions, Autowatts, Bidgely, Bit Stew Systems, Brinck Group, Building Robotics, C&N Engineering, Capgemini, Car Charging Group, Choose Energy, Cisco, Consert, Control4, Cooper Industries, CPvT Energy Asia, cyberGRID, Cylance, Demansys, Eaton, EcoFactor, Ecotality, Eguana Technologies, eMeter, E-mon, Encari, Energy and Power Solutions, Energy Response, EnerNOC, Enertiv, Enlighted, Enmetric Systems, EnTouch Controls, Epyon, ESCO Technologies, FirstFuel Software, FMC-Tech, GE, Global Energy Partners, Green Energy Options (GEO), GreenWave Reality, Gridco Systems, GroundedPower, Gycom, Heijmans, Home Automation, Honeywell, HYTEC Geratebau, Ibis Networks, Ideal Power, Insert Key Solutions, Integrated Metering Systems, Invensys, Itron, JouleX, Keen Home, KEYMILE, Landis+Gyr, LEPService, Leviton, M&C Energy Group, M2M Communications, McWane Technology, Metrum Technologies, Navigation Capital Partners, Nest Labs, Nighthawk, Obvient Strategies, Opal Software, Open Power Quality, Optimum Energy, Panoramic Power, People Power, Pono Home, Powercorp, PowerSecure International, Praxis Technology, PrimeStone, Psymetrix, Recurve, Remote Energy Monitoring, Revolv, RuggedCom, Schneider Electric, SCS Info Tech, Senergy Sistemas de Medicao, Shifted Energy, Siemens, Silver Spring Networks, Site Controls, Skvader Systems, SmallFoot, SmartCloud, SmartSignal Corporation, SmartSynch, SmartThings, SNC-Lavalin, Space-Time Insight, Specialized Technical Services, Stem, Summit Energy, Synapse Wireless, TaKaDu, Telvent, Tendril, Toshiba Corporation, Tropos Networks, Utilidata, Utility Integration Solutions, Varentec, Vcharge, Ventyx, Viridity, Vizelia, WaterSmart Software, Xtensible Solutions, yetu