Total global corporate funding in the solar sector, including venture capital (VC), private equity (PE), debt financing, and other equity financings raised by public companies, came in at $7 billion, compared to $5 billion in Q4 2013.

Raj Prabhu, CEO of Mercom Capital Group, commented, “It was a robust quarter for solar as financing activity surged in almost all areas. The big story continues to be strong capital markets. VC funding was up with several funding deals involving investment “platforms,” while third-party residential/commercial funds continue to raise record amounts.”

VC

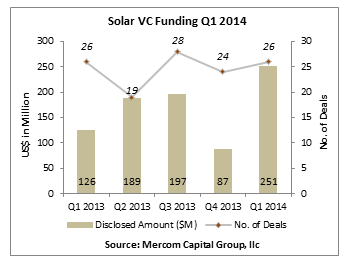

Global VC funding, PE and corporate VC in Q1 2014 totaled $251 million in 26 deals, up from $87 million in 24 deals in Q4 2013, mostly due to one large deal. Solar downstream companies attracted most of the VC funding this quarter, with $182 million in 13 deals.

The largest VC/PE deal in Q1 2014 was the $125 million raised in a Series C round by Renewable Energy Trust Capital, a finance platform established to acquire and own solar projects and provider of a single comprehensive equity capital source. Investors included BlueMountain Capital Management, and Global Cleantech Capital. SolarBridge Technologies, a provider of microinverters and monitoring technology for solar systems, raised $42 million. Investors included Constellation Technology Ventures, Shea Ventures, Rho Ventures, and Prelude Ventures. Other Top 5 deals included the $18 million raised by solar project developer FLS Energy, followed by the for-profit social enterprise d.light, which manufactures and distributes solar lighting and power products, raising $11 million. Off-Grid Electric, a Tanzania-based company providing solar energy in Africa using a prepaid model, raised $7 million.

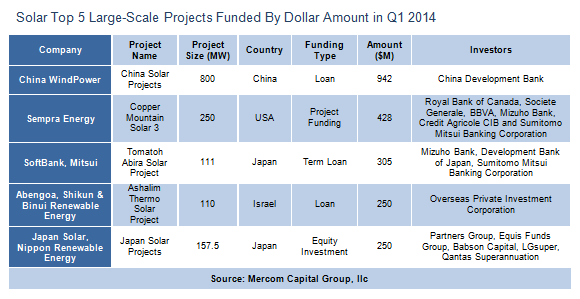

Project Funding

There were 43 large-scale project funding deals totaling $3.6 billion announced in Q1 2014. The Top 5 large-scale project funding deals in Q1 2014 included the $942 million loan to China WindPower Group for a range of Chinese PV projects with a combined capacity of 800 MW, Sempra Energy’s $428 million raise for the development of the 250 MW Copper Mountain Solar 3 Project in Nevada, the $305 million raise by SoftBank and Mitsui for the 111 MW Tomatoh Abira Solar Project in Japan, the $250 million raise by Abengoa/Shikun & Binui Renewable Energy for the 110 MW Ashalim Thermo Solar Project in Israel, and the $250 million raised by Japan Solar/Nippon Renewable Energy to develop Japanese solar projects totaling 157.5 MW.

Third-party/Lease Funds

Mercom also noted the continued upward trend in third-party residential and commercial solar lease fundraising in Q1 2014, tracking more than $1 billion raised. OneRoof Energy, a solar installer and third-party finance firm went public in Q1 2014 via a reverse merger on the Toronto Stock Exchange.

Corporate M&A

Corporate solar M&A activity surged to a record 38 transactions in Q1 2014, up from 25 transactions in Q4 2013. Solar downstream companies were involved in the most number of M&A transactions with 22. “M&A activity was strong among installers, developers, and distributors, while third-party finance firms were actively making acquisitions as they vertically integrate their businesses,” continued Prabhu.

The largest disclosed M&A transaction by dollar amount was the $416 million acquisition by Danfoss of a 20 percent stake in SMA Solar Technology. As part of the deal, SMA acquired Danfoss’ inverter business. This was followed by the $186 million acquisition of a 68 percent stake in Same Time by GCL-Poly Energy. China Electric Equipment Group acquired China Sunergy (Shanghai) for $37.7 million. Solvay America acquired Plextronics (formerly Polytronics), a company specializing in printed solar (OPV inks), lighting and other electronics, for $32.6 million. Rounding out the Top 5 was the Advanced Energy Industries acquisition of the power control module assets of AEG Power Solutions Germany, for $31.5 million.

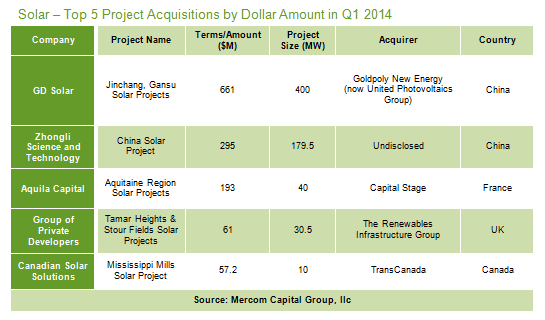

Project Acquisitions

It was also a record quarter for project acquisitions in Q1 2014, totaling $1.5 billion in 42 transactions, with more than 1.7 GW in solar projects changing hands. The top disclosed project acquisition by dollar amount was Goldpoly New Energy’s (now United Photovoltaics Group) acquisition of 400 MW of projects in China from vertically-integrated solar manufacturer GD Solar for $661 million. This was followed by the sale of a 179.5 MW Chinese PV project by Zhongli Science and Technology to an undisclosed investor for $295 million. Solar and wind project operator Capital Stage acquired 40 MW of PV projects in France from investment company Aquila Capital for $193 million. The Renewables Infrastructure Group acquired two projects totaling 30.5 MW from a group of private developers for $61 million, and TransCanada acquired a 10 MW Canadian Solar project in Ontario for $57.2 million.

Mercom also tracked 170 large-scale project announcements worldwide in Q1 2014 representing almost 7 GW.

To get a copy of this report, please email us at info@mercomcapital.com.